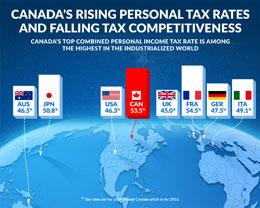

Tax rates hurt Canada’s economic competitiveness

Rising federal and provincial personal income tax rates on highly skilled workers are hurting Canada’s economic competitiveness, concludes a new study published by the Fraser Institute.

The study, Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness, finds that Canada’s top combined federal and provincial tax rate now ranks as the sixth highest among 34 industrialized countries and second highest among G7 countries.

“Competitive personal income tax rates are critical to fostering a positive economic climate but recent tax increases, federally and in many Canadian provinces, harm our ability to attract skilled workers,” said Charles Lammam, director of fiscal studies at the Fraser Institute and study co-author.

For example, this year Canada’s Liberal government increased the top federal tax rate to 33 per cent from 29 per cent. There have been recent tax rate increases in Ontario, Alberta and other provinces.

Nova Scotia has the highest combined top personal income tax rate (54 per cent). Six of 10 provinces have a top combined federal-provincial rate above 50 per cent.

With the new top federal tax rate, British Columbia and New Brunswick have started to reduce their top rate to counteract the effect on their tax competitiveness.